Financial Operations

Disaster Recovery & Business Continuity

Business recovery and business continuity planning prepares companies for unexpected disruptions, from natural disasters to leadership loss. It includes financial safeguards, insurance strategies, and operational contingency plans. Advisors help structure buy-sell agreements and emergency funding options. The goal is to maintain operations and protect stakeholder interests. A solid plan can mean the difference between survival and collapse.

Merchant Services

Merchant services enable businesses to accept payments via credit cards, mobile apps, and online platforms. They include payment processing, point-of-sale systems, and fraud protection. Financial advisors help evaluate providers for cost-efficiency and integration. These services are critical for cash flow and great customer experience. A tailored setup can boost revenue and reduce transaction fees.

Inventory Management (Art & Precious Assets)

Managing high-value assets like art, collectibles, and precious items requires specialized inventory systems. Financial planners help track provenance, valuation, and insurance coverage. This also includes estate planning and liquidity strategies for unique assets. Proper documentation enhances asset protection and resale potential. It’s essential for collectors and investors alike.

Receivables Collections

Receivables collection ensures timely payment from clients and customers, improving cash flow. Financial planners may implement systems for invoicing, follow-ups, and dispute resolution. Outsourcing collections can reduce administrative burden and increase recovery rates. It’s a vital part of working capital management. Efficient collections keep businesses financially healthy.

Bill Payment

Bill payment services automate and manage recurring expenses, from utilities to vendor invoices. Financial planners set up systems to ensure accuracy, timeliness, and cash flow alignment. These services reduce late fees and administrative errors. They’re especially useful for busy executives or family offices. Streamlined bill pay enhances financial control.

Expense Reporting

Expense reporting tracks and categorizes spending for budgeting, reimbursement, and compliance. Financial planners help implement software tools and policies for accuracy. It’s crucial for businesses, executives, and family offices alike. Proper reporting supports tax deductions and financial transparency. Streamlined systems reduce errors and save time.

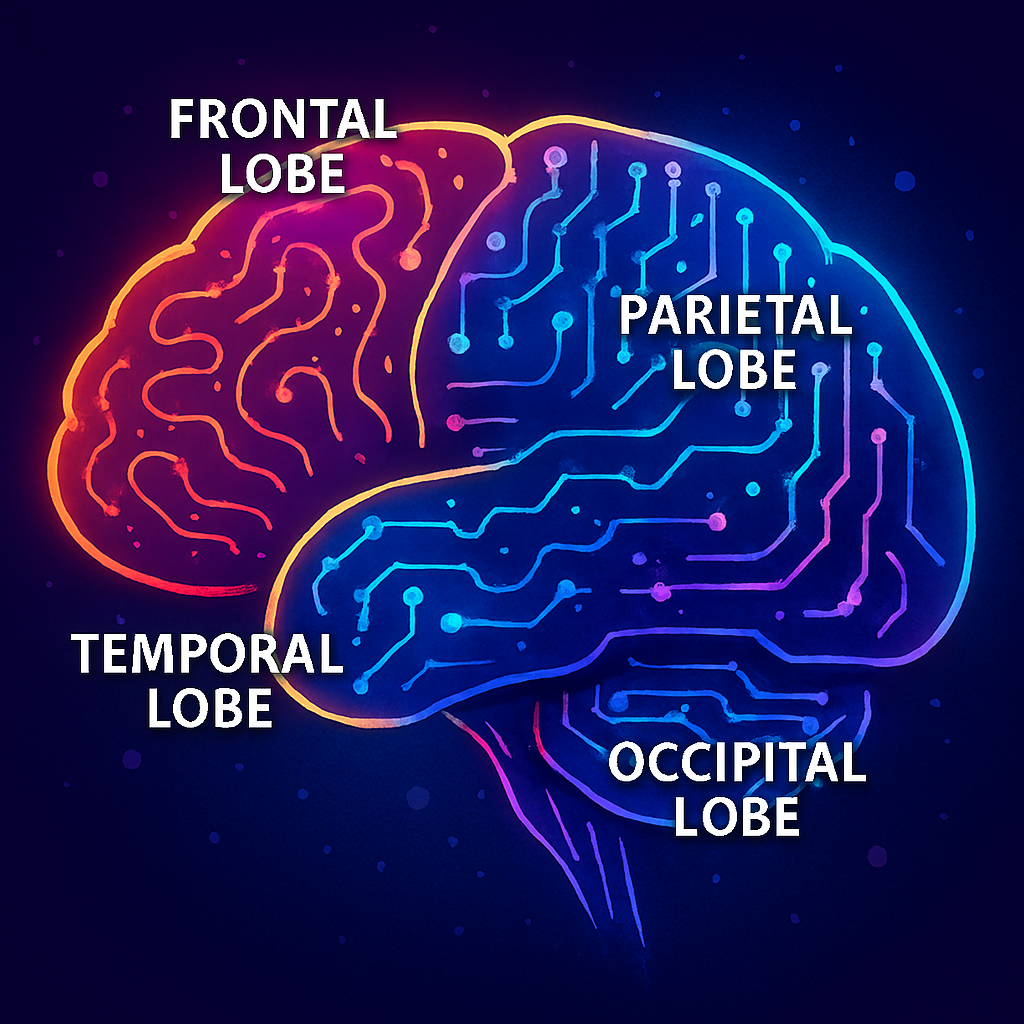

Our bodies operational capabilities are tied to a central activity control center guiding our physical operations.

Our financial control center guides our daily, weekly, monthly and annual operations in a similar fashion.

“The new emphasis on LLM (Large Language Models) is to be more cognitive. In the beginning (~2017) LLMs focused opon just picking the most probably word after the last word. That emphasis grew to include the last few words (known as Attention mechanism). Results for LLMs were astounding. But an area that needed to improve was getting results that were more akin to human thinking, math solutions, reasoning, and logic. The LLMs included data and logic to recognize reasoning. Wrapped altogether, this has become ‘cognition’ and queries, prompts, and questions are getting human like cognitive responses”

Kai Kimball CEO

Financial Operations is where theory and science are put to work together .